Comprehensive Strategies for Effectively Managing Auto Loan Debt in the UK

Exploring Diverse Auto Loan Options Tailored for UK Drivers

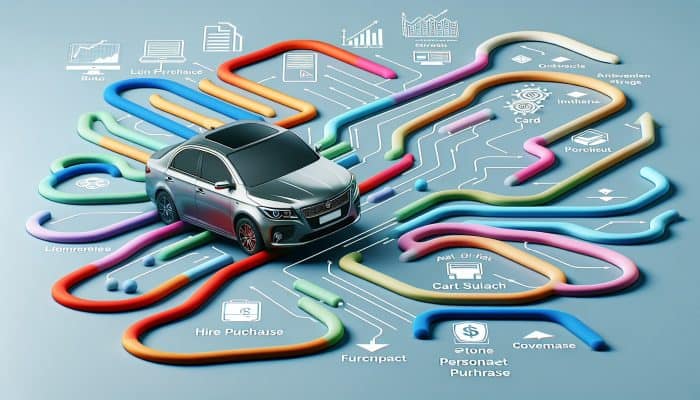

In the context of auto loan debt management within the UK, it is vital to understand the various types of auto loans available, each designed to meet different needs of drivers, accompanied by distinct advantages and considerations. The most prevalent options include hire purchase (HP) and personal contract purchase (PCP). Typically, a hire purchase agreement requires an initial deposit followed by a series of monthly instalments. Upon completion of all payments, ownership of the vehicle transfers to the buyer, making this choice particularly appealing for those who desire full ownership of their vehicle. This arrangement is ideal for individuals who prefer a clear pathway to owning their car outright, eliminating any lingering obligations once the payment schedule is fulfilled.

Conversely, the personal contract purchase option provides borrowers with greater flexibility. PCP agreements usually involve a lower upfront deposit and reduced monthly payments compared to traditional HP options. At the end of the contract term, individuals face a final ‘balloon’ payment to acquire the vehicle, or they can opt to return the car or trade it in for a newer model. This financing method appeals to those who enjoy changing their vehicles regularly. It is crucial to conduct a comprehensive assessment of both options to ensure they align with personal financial situations and driving habits before making a commitment.

Additionally, many dealerships throughout the UK offer promotional incentives, such as 0% finance or cashback offers, which can significantly enhance the affordability of an auto loan. Gaining an in-depth understanding of these loan types empowers prospective borrowers to make informed choices that align with their financial circumstances, helping them avoid the traps associated with overwhelming debt burdens.

Interpreting Interest Rates and Loan Terms for Auto Financing in the UK

The landscape of <a href="https://limitsofstrategy.com/debt-consolidation-guide-for-variable-interest-rates/">interest rates</a> and repayment terms for auto loans in the UK is diverse and influenced by a variety of factors, including lender policies, the borrower’s credit score, and the specific loan type selected. Generally, interest rates for auto loans range from 3% to 10%, with numerous lenders offering competitive rates to attract new clients. Borrowers with strong credit scores often qualify for lower rates, underscoring the importance of understanding one’s credit position before pursuing various financing options.

Moreover, the repayment terms have a considerable impact on the total cost of the vehicle for borrowers. Most loans in the UK typically offer terms ranging from 1 to 5 years, or approximately 36 to 60 months. Choosing shorter repayment terms may result in higher monthly payments but lower overall interest paid throughout the loan duration. In contrast, longer repayment terms can ease monthly cash flow yet increase the total interest incurred over time.

Consumers are encouraged to explore multiple lenders to identify the most favourable rates and terms by evaluating both online lenders and traditional banks, as many financial institutions provide useful tools for comparing options. By understanding the intricacies of interest rates and loan terms, potential borrowers can develop effective strategies for their loan selections, thereby minimising any long-term financial strain.

Assessing the Impact of Auto Loan Debt on Your Credit Score

Auto loan debt can have a profound effect on your credit score in the UK. When borrowers obtain an auto loan, it is reported to credit agencies, which impacts their credit utilisation ratio, accounting for 30% of the overall credit score. Consistent and timely repayments can positively enhance the score, while missed payments may lead to a significant decrease, underscoring the importance of maintaining a reliable repayment schedule.

Furthermore, the duration of a borrower’s credit history is another critical factor influenced by auto loans. A well-managed auto loan can positively contribute to one’s credit history, demonstrating responsible repayment behaviour. Conversely, defaulting on an auto loan or accumulating late payments can have severe repercussions, including defaults or repossessions that can tarnish a credit file for several years.

To sustain or enhance one’s credit standing, borrowers must consistently make timely payments, work to reduce any outstanding balances, and avoid taking on excessive debt relative to their income. Understanding the relationship between auto loan debt and credit scores is vital for consumers looking to secure better financial opportunities in the future.

Practical Strategies for Efficiently Managing Auto Loan Debt

Effectively managing auto loan debt requires meticulous planning and unwavering discipline. A fundamental strategy involves creating a comprehensive budget that outlines all sources of income and expenditures, ensuring that loan payments are included without compromising other financial obligations. This approach allows borrowers to identify areas where they can cut back on spending and redirect those funds towards their auto loan repayments.

Moreover, making additional payments towards the principal amount can significantly decrease the total interest paid over the lifespan of the loan. Even modest additional payments can shorten the repayment period and enhance the overall financial outlook. Refinancing an auto loan may also be advantageous if interest rates drop or if the borrower’s credit score improves, potentially resulting in lower monthly payments and reduced total interest expenses.

Establishing an emergency fund is equally crucial. This financial safety net can prevent reliance on credit cards or loans during unforeseen circumstances, consequently minimising the risk of falling behind on auto loan payments. By adopting a proactive approach to managing auto loan debt, borrowers can maintain financial stability and reduce the stress associated with vehicle financing.

Understanding the Legal Aspects of Auto Loan Agreements

In the UK, comprehending the legal dimensions of auto loans is vital for protecting consumer rights. The Consumer Credit Act 1974 governs the majority of auto loan agreements, requiring lenders to provide clear and transparent information regarding loan costs and terms. This legislation ensures that borrowers receive a written agreement that outlines their rights and obligations.

Additionally, consumers are entitled to fair treatment from lenders. If a borrower experiences difficulties in making payments, they should communicate with the lender to explore potential solutions, such as payment holidays or loan restructuring. Failing to communicate can lead to severe consequences, including vehicle repossession, making it imperative to fully understand these rights.

Furthermore, borrowers should be aware of the consequences of defaulting on a loan. Non-payment can trigger further legal actions from the lender, which can significantly damage one’s credit rating. Familiarising oneself with these legal considerations empowers consumers to navigate the auto loan landscape effectively, ensuring informed decisions that protect their financial futures.

Discovering the Advantages of Debt Consolidation

Securing Lower Interest Rates Through Debt Consolidation

One of the primary benefits of consolidating auto loan debt is the opportunity to relieve the burden of high-interest rates. When individuals pursue consolidation, they typically secure a new loan at a lower interest rate than their existing debts. This reduction can lead to significant savings over time, making monthly payments considerably more manageable.

In the UK, various lenders provide competitive rates for personal loans specifically designed for debt consolidation. Borrowers with strong credit scores may discover even lower rates, further reducing their monthly expenses. This situation is particularly advantageous for those managing multiple high-interest obligations, such as credit cards or personal loans, alongside their auto loan.

Moreover, consolidating auto loans simplifies financial management. Instead of keeping track of several payments with different due dates, borrowers can streamline their finances into a single monthly payment. This simplification significantly reduces the risk of missed payments, which could incur additional fees and increase interest rates, compounding financial stress.

By prioritising debt consolidation to secure lower interest rates, borrowers can foster a more sustainable financial outlook, paving the way for improved credit health and overall fiscal well-being.

Simplifying Payment Structures Through Debt Consolidation

Debt consolidation undoubtedly offers the advantage of streamlined payments, significantly improving a borrower’s ability to manage their finances. Instead of juggling multiple payments to various creditors, consolidation allows individuals to merge these obligations into one monthly payment. This straightforward approach not only simplifies the management of various due dates but also aids in tracking overall debt levels.

For many UK borrowers, this translates to reduced stress associated with remembering payment deadlines. A simplified payment structure promotes timely repayments, which is crucial for maintaining a healthy credit score. Additionally, this consolidated payment is often less than the sum of previous payments, primarily due to the lower interest rates associated with consolidation loans.

Furthermore, lenders frequently offer online tools and resources that enable borrowers to set up automatic payments. This feature can further facilitate the process and mitigate the risk of late fees or diminished credit scores resulting from missed payments. Ultimately, the convenience of a consolidated payment plan can make managing auto loan debt a more straightforward and less intimidating task.

Enhancing Your Credit Rating with Debt Consolidation

One of the most compelling advantages of consolidating auto loan debt is the potential for a significantly improved credit rating. When borrowers consolidate their debts, they effectively lower their credit utilisation ratio by eliminating existing debts, a critical component in credit scoring models. A decreased credit utilisation ratio can contribute to a higher credit score over time, unlocking better financial opportunities, such as lower interest rates on future loans and more favourable credit terms.

Moreover, consistently making timely payments on the new consolidated loan bolsters creditworthiness. Lenders favour borrowers who demonstrate responsible repayment behaviour, making it essential to establish a solid track record following the consolidation of their debt. Over time, prudent debt management can lead to an even higher credit score, granting access to premium financial products.

In the UK, maintaining a good credit rating is vital for a healthy financial future, as it impacts various aspects, from mortgage applications to insurance premiums. By consolidating auto loan debt and focusing on timely repayments, borrowers can significantly enhance their credit ratings, reaping long-term benefits and achieving financial freedom.

Identifying the Best Debt Consolidation Options for Your Unique Needs

Leveraging Personal Loans for Effective Debt Consolidation

Personal loans provide a practical solution for consolidating debt, allowing borrowers to merge multiple debts, including auto loans, into a single loan characterised by a fixed interest rate. In the UK, personal loans are available through banks, credit unions, and online lenders. Borrowers should conduct thorough evaluations of various lenders to identify the most competitive rates and terms that suit their financial needs.

When considering a personal loan for debt consolidation, understanding the loan’s terms is crucial, including the interest rate, repayment duration, and any fees involved. Typically, unsecured personal loans carry higher interest rates than secured loans, as they do not require collateral. However, they offer flexibility, enabling borrowers to consolidate debts without risking their assets.

Many lenders also provide pre-qualification tools that allow borrowers to determine potential loan amounts and interest rates without impacting their credit scores. This process empowers individuals to make informed decisions based on their specific financial situations.

Ultimately, personal loans can serve as a powerful tool in managing and consolidating auto loan debt, provided borrowers conduct thorough research and select the right lender for their specific circumstances.

Utilising Home Equity Loans for Debt Consolidation

Home equity loans offer an alternative method for consolidating auto loan debt, enabling borrowers to leverage the equity accumulated in their properties. This option can be particularly advantageous for homeowners seeking to lower high-interest debts while accessing lower interest rates typically associated with home equity financing. In the UK, these loans often feature significantly lower rates than unsecured personal loans.

However, utilising a home equity loan for debt consolidation carries inherent risks. Borrowers effectively place their homes at risk; failing to meet loan repayments could lead to foreclosure. Therefore, it is essential for homeowners to carefully assess their financial situations and ensure they can manage the new loan payments without jeopardising their homes.

Additionally, the application process for a home equity loan often involves extensive paperwork and a credit check, making it crucial for borrowers to be well-prepared. Those considering this option should seek guidance from financial advisors or mortgage brokers to navigate the complexities and secure the best possible terms available in the market.

While using home equity for debt consolidation can indeed be a powerful strategy for some, it necessitates careful consideration and planning to avoid potential pitfalls that could adversely affect one’s financial stability.

Investigating Balance Transfer Credit Cards for Debt Consolidation

Balance transfer credit cards present a strategic solution for consolidating auto loan debt by transferring existing debts to a new credit card with a lower interest rate. In the UK, many balance transfer credit cards offer introductory rates with 0% interest for a limited period, allowing borrowers to pay down their debts without incurring interest charges.

This option is particularly appealing for those with smaller auto loans or other debts, as it consolidates payments into a single monthly obligation. Furthermore, borrowers can achieve significant savings during the introductory phase, enabling them to concentrate more aggressively on repaying the principal balance.

However, caution is paramount when considering balance transfers. Many cards impose transfer fees, and once the promotional period expires, the interest rates may increase, often surpassing standard rates. Borrowers must ensure they have a repayment strategy in place to settle the transferred balance before the promotional period concludes, thereby avoiding unexpected interest charges.

To maximise the benefits of balance transfer credit cards, consumers should carry out thorough research and meticulously scrutinise the terms, ensuring they fully comprehend the fee structures and interest rates. With the right approach, this method of debt consolidation can yield significant savings and enhance financial health.

Implementing Debt Management Plans for Effective Debt Consolidation

Debt management plans (DMPs) offer a structured approach for individuals facing multiple debts, including auto loans. In the UK, these plans allow borrowers to negotiate with creditors to establish a manageable repayment strategy, often resulting in reduced monthly payments and potentially lower interest rates. DMPs are typically organised through a debt management company, which assists in overseeing payments and liaising with creditors.

One of the primary advantages of a DMP is the ability to consolidate payments into a single monthly sum, simplifying the debt repayment process. Participants are encouraged to make regular payments to the plan, which are then distributed to creditors. This method alleviates the stress of managing various debts, providing a clear path toward financial recovery.

However, entering into a DMP does come with certain implications. It may affect the borrower’s credit rating, as creditors will note the arrangement. Additionally, DMPs usually last several years, and borrowers must diligently adhere to the agreed-upon payment plan. Therefore, individuals considering this option should thoroughly evaluate their financial situations and consult with a qualified advisor to ensure it aligns with their long-term financial objectives.

A well-structured DMP can significantly assist in consolidating auto loan debt, providing a practical solution for those seeking to regain control over their finances.

Essential Steps for Successfully Consolidating Auto Loan Debt

Conducting a Thorough Assessment of Your Current Debt Landscape

The initial step in the debt consolidation process involves a meticulous evaluation of your current financial standing. This entails gathering all pertinent financial documents, including loan statements, credit card bills, and income records. By compiling this information, borrowers can attain a comprehensive understanding of their total debt burden, interest rates, and monthly payment obligations.

Subsequently, it is crucial to assess the types of debts owed. For instance, are there high-interest debts that should be prioritised for consolidation? Identifying debts with the highest interest rates will assist in formulating a more effective consolidation strategy. Additionally, evaluating credit scores can provide insights into eligibility for various consolidation options, allowing borrowers to approach lenders with a realistic perspective of their financial situations.

Lastly, borrowers should consider their budget and monthly expenses during their debt assessment. Recognising areas where expenditures can be trimmed can free up additional resources, facilitating a quicker repayment of consolidated debts. This comprehensive assessment lays the foundation for a successful debt consolidation journey, ensuring borrowers make informed choices tailored to their specific financial needs.

Comparing Lenders for Optimal Debt Consolidation Solutions

Once borrowers have assessed their debts, the next critical phase is to compare lenders and identify the best debt consolidation options available. The UK market features a wide array of lenders, including traditional banks, credit unions, and online financial institutions, each presenting varying rates and terms. By thoroughly comparing these alternatives, borrowers can secure the most advantageous deal suited to their circumstances.

When evaluating lenders, consider factors such as interest rates, repayment terms, and any associated fees. Some lenders may offer low-interest rates but impose high origination fees, whereas others may provide fee-free options with higher rates. Carefully reviewing the fine print is essential to ensure that borrowers fully comprehend the total cost of the loan over its entire duration.

Additionally, it is beneficial to peruse customer reviews and seek recommendations from trusted sources. Understanding the experiences of others can provide valuable insights into a lender’s reliability and the quality of customer service. Those facing challenges or who have inquiries should opt for lenders that offer robust support throughout the loan process.

By diligently comparing lenders, borrowers can make informed decisions that align with their financial goals, ultimately leading to successful debt consolidation and enhanced financial stability.

Completing the Application Process for Debt Consolidation

Initiating the application for debt consolidation related to auto loan debt is a vital step in the journey toward financial recovery. Before commencing the application process, borrowers should ensure they have completed the necessary pre-application steps, which include assessing their debt and comparing lenders. A well-prepared application can significantly influence the approval process.

When applying, borrowers generally need to provide personal information, including income details, employment history, and existing debt commitments. Many lenders also conduct credit checks, which may temporarily affect the borrower’s credit score. To enhance the likelihood of approval, it is crucial to present a solid financial profile that demonstrates income stability and a responsible credit history.

After submitting the application, borrowers should remain attentive and responsive to any requests from the lender for additional documentation or information. It is also wise to carefully review and comprehend the loan agreement before accepting the offer. Being aware of interest rates, repayment terms, and any fees associated with the loan is vital for ensuring financial preparedness.

Once approved, borrowers can proceed with consolidating their debts, paving the way to enhanced financial health and a more streamlined repayment process.

Understanding the Terms of Debt Consolidation Agreements

A critical component of the debt consolidation process is achieving a comprehensive understanding of the terms and conditions associated with the new loan. Borrowers should meticulously review the agreement before signing, paying particular attention to interest rates, repayment schedules, and any applicable fees.

Interest rates should be compared against existing debts to ascertain potential savings. Borrowers must also consider whether the new loan offers fixed or variable rates, as this can impact monthly payments and overall debt repayment. Fixed rates provide predictability, while variable rates may fluctuate, potentially leading to higher payments in the future.

Repayment schedules warrant careful consideration as well. Understanding the length of the loan term enables borrowers to effectively plan their budgets, ensuring they can meet monthly obligations without accruing additional debt. Furthermore, being aware of any penalties for early repayment or late fees can help prevent unexpected financial setbacks in the future.

By diligently reviewing consolidation terms, borrowers can avoid pitfalls, make informed choices, and ensure they select an option that aligns with their long-term financial goals.

Effectively Managing Finances After Debt Consolidation

Successfully overseeing finances following the consolidation of auto loan debt is paramount for maintaining financial stability and preventing a return to debt. After consolidation, it is essential to create a realistic budget that accommodates the new loan payments. This budget should accurately reflect all current income sources and expenditures, ensuring that all financial commitments are met without undue strain.

Borrowers should also prioritise establishing an emergency fund. Unexpected costs can disrupt even the most meticulously constructed budgets, and having a financial cushion can prevent the need to rely on credit cards or loans. It is advisable to save at least three to six months’ worth of living expenses as a safeguard against unforeseen circumstances.

Regularly assessing financial progress is equally vital. Keeping track of payments and monitoring the remaining balance on the consolidated loan helps borrowers stay motivated and informed about their financial situations. This vigilance can also reveal opportunities for making additional payments to expedite debt reduction.

By adopting disciplined financial habits and maintaining a proactive approach, borrowers can successfully manage their finances after consolidation, leading to greater financial stability and peace of mind.

Recognising Risks and Considerations in Debt Consolidation

Identifying the Risk of Increased Debt Accumulation

One of the primary risks associated with debt consolidation is the potential for increased debt, which can occur if borrowers are not vigilant. Upon consolidating their debts, individuals may inadvertently gain access to new credit lines or larger loans, fostering a deceptive sense of financial security. If they do not alter their spending habits, they may find themselves accruing new debts alongside their consolidated loans.

Moreover, if borrowers fail to manage their finances effectively and revert to previous spending patterns, they may end up deeper in debt than they initially were. This scenario is particularly common among those who consolidate credit card debt only to accrue new charges on the now-empty cards.

To mitigate this risk, borrowers must implement stringent budgeting practices and refrain from accumulating additional debt during the consolidation process. Establishing a clear financial plan that prioritises debt repayment can help circumvent the pitfalls of increased debt levels, ensuring that consolidation serves as a stepping stone toward financial recovery rather than a pathway to further hardship.

Understanding the Impact of Debt Consolidation on Homeownership

Utilising home equity loans for debt consolidation can significantly influence homeownership and overall financial stability. While leveraging home equity can yield lower interest rates and larger loan amounts, it also introduces considerable risks. Borrowers who fail to repay their home equity loans risk losing their homes through foreclosure, a process that can have devastating consequences for families and individuals alike.

Additionally, using home equity for debt consolidation can limit future financial flexibility. By tying up equity in a home, borrowers may encounter challenges when attempting to access funds for other necessities, such as emergencies, education, or retirement savings. This limitation can create long-term financial strain, especially if the equity was intended for future investments or home improvements.

To ensure that homeowners make informed decisions, it is essential to evaluate their ability to manage additional debt responsibly. Consulting with financial advisors or mortgage specialists can provide insights into the implications of utilising home equity for consolidation. By fully understanding these risks, borrowers can make choices that align with their long-term financial objectives without jeopardising their homeownership.

Establishing a Comprehensive Long-Term Financial Plan Post-Consolidation

Long-term financial planning is a crucial element of consolidating auto loan debt, as it lays the groundwork for future financial stability and success. Following consolidation, individuals should assess their overall financial situation, considering factors such as income, expenses, savings goals, and retirement plans. This holistic perspective enables borrowers to create a roadmap for sustainable financial health.

Establishing clear financial objectives—whether saving for a home, planning for retirement, or funding education—provides direction and motivation in managing debt. Borrowers should also consider collaborating with financial planners or debt advisors to develop tailored strategies that cater to their unique circumstances and aspirations.

Additionally, regularly reviewing and adjusting financial plans in response to evolving circumstances is essential. Life events, such as job changes, family growth, or shifts in financial priorities, can impact an individual’s financial landscape. By remaining proactive and adaptable, borrowers can ensure they maintain progress toward their goals, significantly reducing the risk of falling back into debt after consolidation.

Ultimately, a commitment to long-term financial planning empowers individuals to take control of their financial futures, ensuring that debt consolidation serves as a positive step forward rather than a temporary fix.

Inspirational Success Stories and Practical Management Tips

Case Studies Showcasing Successful Debt Consolidation

Numerous individuals in the UK have effectively navigated the complexities of consolidating auto loan debt, demonstrating that with the right strategies, financial recovery is achievable. For instance, Sarah, a single mother from Manchester, confronted overwhelming debts, including an auto loan and credit card payments. By consolidating her debts into a personal loan with a lower interest rate, she simplified her monthly finances, freeing up funds for her children’s education.

Similarly, Tom and Rachel, a couple from London, opted for a debt management plan after realising that their debts were spiralling out of control. With the assistance of a debt management company, they negotiated lower payments and reduced interest rates. By remaining committed to their repayment plan, they successfully eliminated their debts in three years, regaining financial stability and enhancing their credit scores.

These success stories serve as motivating examples for others facing debt challenges. By implementing strategic debt consolidation techniques, individuals can take meaningful steps toward overcoming financial obstacles, ultimately leading to improved credit health and greater peace of mind.

Effective Strategies for Successfully Managing Consolidated Debt

Upon successfully consolidating their auto loan debt, borrowers must prioritise effective management to maintain financial stability. A key strategy is to develop a detailed budget encompassing all monthly expenses and the new consolidated loan payment. By allocating funds judiciously, borrowers can ensure they meet all obligations without falling behind.

Moreover, establishing automated payments can help prevent missed payments, which can incur late fees and negatively impact credit scores. Many lenders offer this service, providing peace of mind and mitigating the risk of financial mismanagement.

Furthermore, regularly reviewing credit reports to monitor progress is prudent. Understanding how consolidation affects credit scores can motivate individuals to uphold responsible financial practices. Additionally, tracking credit enhances awareness of any discrepancies, allowing borrowers to address issues promptly.

Ultimately, committing to ongoing financial education can empower individuals to make informed decisions about their debt consolidation journey. Accessing resources, attending workshops, or consulting financial advisors can provide valuable insights into managing debt and fostering a secure financial future.

Strategies for Preventing Future Debt Accumulation

Avoiding future auto loan debt necessitates a proactive approach and the establishment of sound financial habits. After consolidating debt, individuals should focus on effective budgeting to avert unnecessary expenditures. Crafting and adhering to a monthly spending plan can significantly mitigate the temptation to overspend, keeping debt levels manageable.

Moreover, understanding the importance of saving for future purchases rather than relying on financing is crucial. Cultivating an emergency fund can serve as a cushion against unexpected expenses, ensuring that individuals do not resort to credit for unforeseen costs. Additionally, setting aside funds for future vehicle purchases can eliminate the need for auto loans.

Education plays a pivotal role in avoiding future debt. By acquiring knowledge about personal finance, borrowers can make informed decisions that align with their financial objectives. Resources such as budgeting tools and debt management applications can assist in maintaining awareness of spending habits and financial responsibilities.

By implementing these strategies, individuals can prevent falling back into the cycle of debt, ensuring that their consolidated loan becomes a stepping stone toward lasting financial freedom.

Recognising the Significant Benefits of Debt Consolidation

The primary benefits of consolidating auto loan debt include enhanced credit scores, reduced interest rates, and streamlined payment structures. By merging multiple debts into a single loan, borrowers can lower their monthly payments and access more favourable terms.

Moreover, timely repayments on the consolidated loan can lead to a notable improvement in credit ratings. This enhancement opens doors to superior financial opportunities, such as lower rates on future loans. Additionally, simplifying finances enables more effective monthly budget management, alleviating stress and facilitating clearer financial planning.

Gaining a clear understanding of the advantages of debt consolidation empowers individuals to take control of their financial futures and make informed decisions. With the right strategy and commitment, consolidation can pave the way for long-lasting financial stability.

Frequently Asked Questions Regarding Debt Consolidation

What does debt consolidation for auto loan debt involve?

Debt consolidation for auto loan debt entails combining multiple debts, including auto loans, into a single loan with a potentially lower interest rate, thereby simplifying payments and enhancing overall financial management.

How does debt consolidation affect my credit score?

Debt consolidation can positively impact your credit score by reducing your credit utilisation ratio and enabling more manageable monthly payments. Consistent repayments on the new loan can further improve your credit rating.

What are the main categories of debt consolidation options available?

The primary categories of debt consolidation options include personal loans, home equity loans, balance transfer credit cards, and debt management plans, each presenting unique benefits and risks.

Is it feasible to consolidate auto loan debt with poor credit?

Yes, consolidating auto loan debt with poor credit is possible, although options may be limited. Borrowers might consider secured loans or debt management plans to ameliorate their financial situations.

Can I consolidate my auto loan and credit card debts into one payment?

Yes, many debt consolidation options allow for the amalgamation of various debt types, including auto loans and credit card debts, into a single payment for easier management.

What factors should I consider before consolidating my debts?

Before consolidating debts, consider your total debt amount, interest rates, associated fees with consolidation, and your ability to adhere to new repayment plans to prevent future financial strain.

How long does it typically take to improve my credit score after consolidation?

Improvements in your credit score following consolidation can vary, but with consistent and timely payments, it may take several months to notice a significant increase.

Are there any fees related to debt consolidation?

Yes, depending on the chosen consolidation type, fees may apply, including application fees, origination fees, or balance transfer fees. It’s crucial to review all terms thoroughly.

What are the consequences of defaulting on my consolidated loan?

Defaulting on a consolidated loan can lead to severe repercussions, including potential legal action from lenders, loss of assets if secured, and a substantial negative impact on your credit score.

Where can I seek assistance for debt consolidation in the UK?

Assistance for debt consolidation can be sourced through financial advisors, debt management companies, and online resources that offer guidance tailored to individual circumstances and needs.

Connect with us on Facebook!

This Article Was First Found On: https://www.debtconsolidationloans.co.uk

The Article Debt Consolidation: Your Comprehensive Guide to Auto Loans Was Found On https://limitsofstrategy.com